Altus Energy Insights

South Australian Electricity Network Tariff Changes

From the 1st July 2020, SA Power Networks has introduced changes to their large customer network tariffs.

From the 1st July 2020, SA Power Networks has introduced changes to their large customer network tariffs.

Network tariffs can sometimes appear to be confusing to many end-users. These tariffs can vary considerably between different state networks but are usually comprised of the following elements:

1. Supply charge $/day – which is the same rate for all customers within each tariff class

2. Usage charge $/kWh – based on the amount of electricity used, with often higher rates during the peak period and lower during the off-peak and shoulder periods

3. Demand charge $/kVA – based on the maximum capacity of the infrastructure required to service the customer, with a higher rate during the peak period and a lower rate during the off-peak periods

In South Australia, most large customers (> 160 MWh/year) were previously […]

Reducing Energy Costs In Quarrying

Quarries use a large amount of energy in the form of explosives, diesel and electricity and managing and reducing energy costs is critical to increasing profitability. With energy costs increasing rapidly over the last few years the profitability of quarries is being squeezed and the ability to get a return on growth projects is being hampered.

Quarries do not have to be a victim of the traditional three-yearly retail price competitive process. Quarry owners can take back control of their energy spend, reduce their costs, grow profits and reinvest for further growth.

This article provides a framework that quarries can […]

Business Travel Productivity Hacks

I’m keen to collect tips on how people maintain or even enhance productivity on business trips and stay healthy.

I’m keen to collect tips on how people maintain or even enhance productivity on business trips and stay healthy.

It can be hard being away from family, staying in lonely hotel rooms, eating out and being outside your normal routine. Some people thrive in this environment, advancing their key goals forward whilst others just turn up and then wonder what they achieved all week. Some people who travel regularly appear fit, healthy and active whilst others slowly gain waist size and look tired and possibly hungover.

For more than a two decades I have had regular (weekly or fortnightly) business trips. Some have been highly productive and have moved my team’s objectives forward whilst others have seemed like a waste of time and money.

I have also found a correlation […]

How your business can make immediate electricity cost savings

Many businesses have the mistaken belief that their only opportunity to reduce electricity costs is when their contract runs out and they run a competitive process for a new contract.

In reality, that competitive process is usually between a small number of traditional retailers who are basing their pricing on the same wholesale market and derivative market prices.

The real opportunity to achieve deep cost savings sits outside of this process and can be achieved at any time irrespective of the contract.

The key to reducing electricity costs is to reduce how much electricity you use and how much you pay for network charges. Electricity prices have been increasing over the last few years but by using less electricity and reducing network charges you can offset the price increases.

Reducing electricity […]

The Price Is The Price – But That Doesn’t Mean It’s The Cost

Every day we get inundated with media articles (and Linkedin posts) about the causes and impacts of rapidly escalating electricity Prices. Yes, rising electricity Prices are of concern but higher electricity Prices do not have to mean rising electricity Costs.

Every day we get inundated with media articles (and Linkedin posts) about the causes and impacts of rapidly escalating electricity Prices. Yes, rising electricity Prices are of concern but higher electricity Prices do not have to mean rising electricity Costs.

Our electricity market is designed to have periods of high Prices in order to send a signal that investment is needed in new generation capacity. Unfortunately, at the moment, we are caught in one of those periods due to the recent retirement of some coal fired generation plants.

Price is not the same as Cost. The Price of something is the amount that you pay per unit and in the context of electricity it is the price in kilowatt-hours (kWh).

The Cost is how much you pay in total for something and is […]

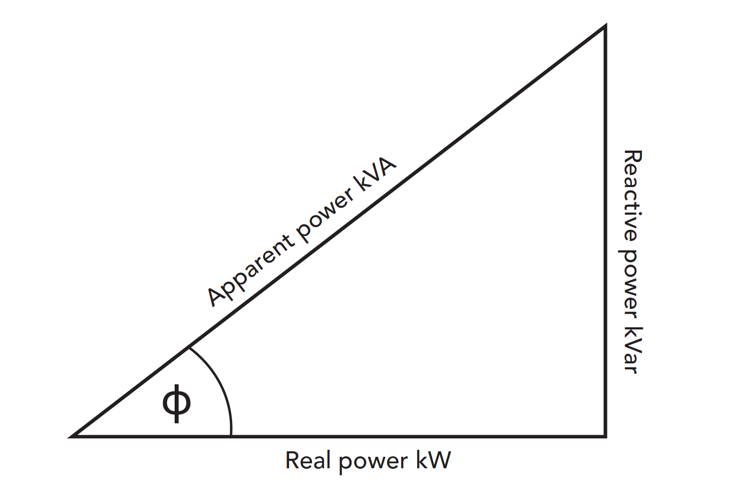

Reducing Electricity Network Costs Through Power Factor Correction

In this article we look at how electricity costs can be reduced by improving power quality and revise some high school trigonometry.

In this article we look at how electricity costs can be reduced by improving power quality and revise some high school trigonometry.

Many businesses that I talk with think they only get one shot to reduce their electricity costs and that is when they “negotiate” their new contract. That is far from the case. In fact, the outcome of a skilled negotiation for a new supply arrangement only yields a small cost savings compared with other opportunities.

As readers of previous articles have seen, there are many other ways to reduce electricity costs even during the term of an existing supply agreement. These include electricity efficiency measures, load shifting, choosing the right tariff and investing in renewable generation.

The part of the electricity supply agreement that you “negotiate” with retailers […]

South Australian Network Cost Savings

For people who are not excited by energy, navigating the murky world of network tariffs can be complicated and confusing.

For people who are not excited by energy, navigating the murky world of network tariffs can be complicated and confusing.

The network tariff component of the electricity bill reflects the costs of the “poles and wires” and other equipment such as transformers required in order to get the electrons from the generator to your home or business.

In my book Power Profits I discuss how understanding your bill is an important step in reducing electricity costs. The components of the bill represent the levers that you can pull to reduce the costs.

In an effort to keep everyone confused, every network jurisdiction has different network tariff methodologies for the same class of customers. Network tariffs are meant to be cost reflective meaning different classes of customers are charged depending […]

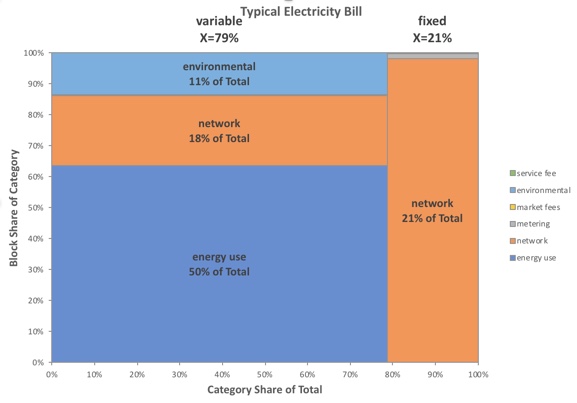

Electricity Bill Visualisation Using Marimekko Charts

This week I listened to a Tim Ferriss podcast interview with Nick Kokonas who is the co-owner and co-founder of The Alinea Group of restaurants in the U.S.

Nick explained the power of Marimekko charts in analysing restaurant costs to determine priority areas for finding cost reductions and improving profitability.

I thought I would have to start using Marimekko charts for my own cost analysis and for visually explaining electricity bills and the relative importance of each of the components.

I downloaded the Excel add-in Peltier Tech Charts and constructed a Marimekko chart for the breakdown of a typical small business electricity bill (see above chart) . In this case I broke the bill components further into variable (c/kWh) and fixed ($ or $/kVA) to visually show how much of a typical […]

Energy Efficiency and The Competition For Capital

Irrespective of the profitability and size of a business, the amount of capital that is invested in any year to sustain, de-risk or grow the business is limited, and the “shopping list” of projects is usually much larger than the funds available.

Irrespective of the profitability and size of a business, the amount of capital that is invested in any year to sustain, de-risk or grow the business is limited, and the “shopping list” of projects is usually much larger than the funds available.

In some tough years the available capital may be very low or none at all.

Projects for growth, efficiency, equipment replacement, safety, quality, environmental and staff amenity projects are all fighting for a share of the same limited capital.

As a general rule of thumb in many manufacturing businesses in the post GFC era, capital investment in new plant and equipment to increase efficiency and reduce costs usually requires a simple payback of less than two years. In tough times that payback period is often reduced to one […]

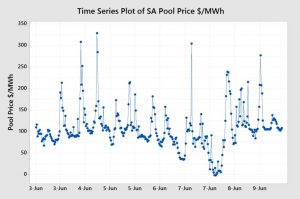

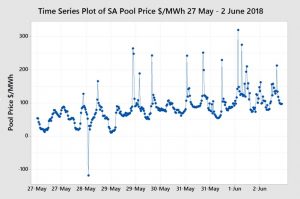

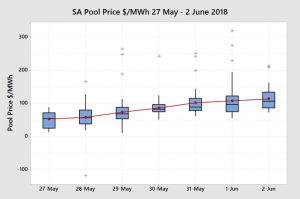

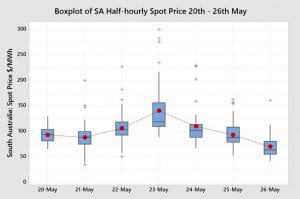

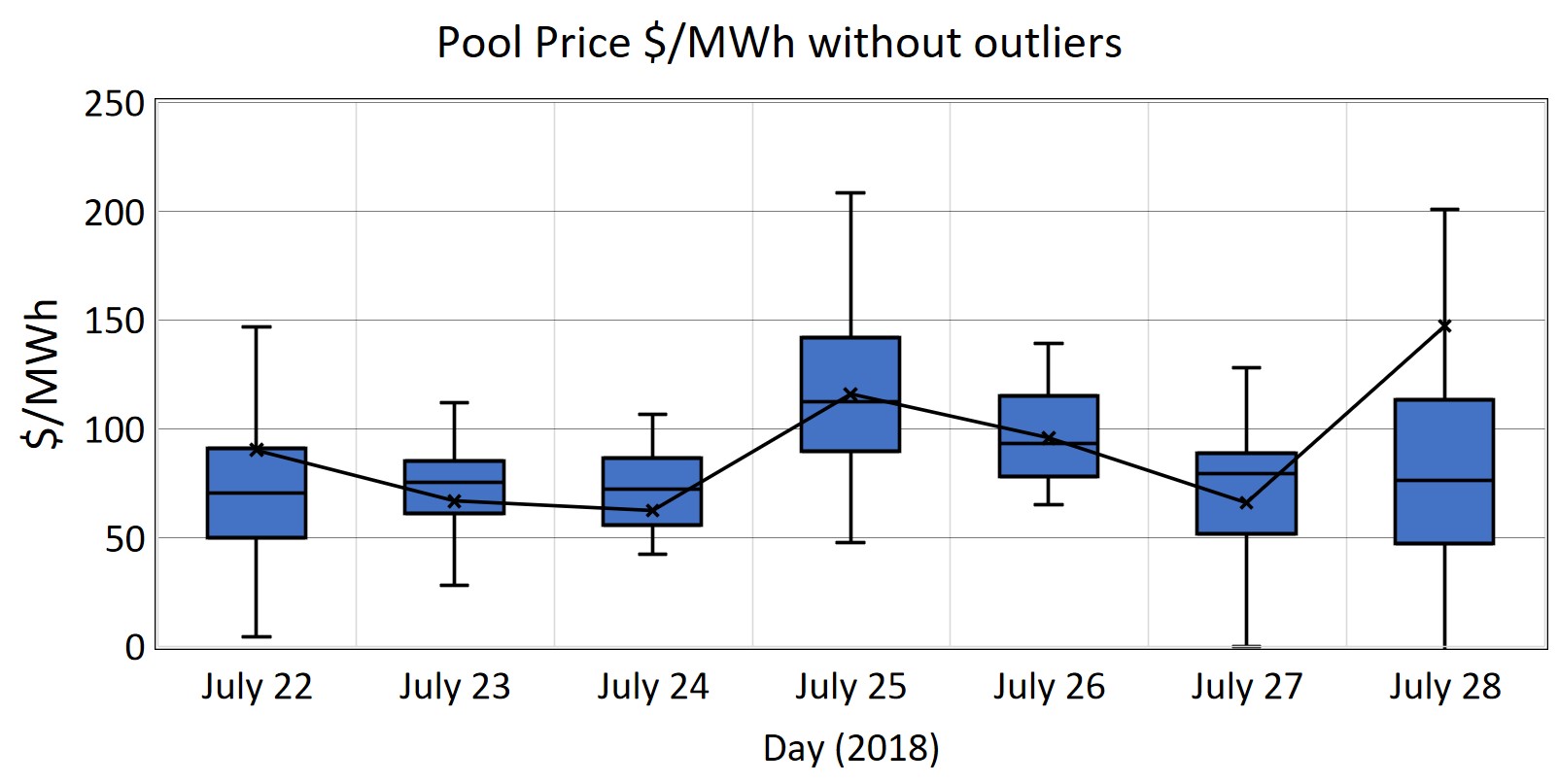

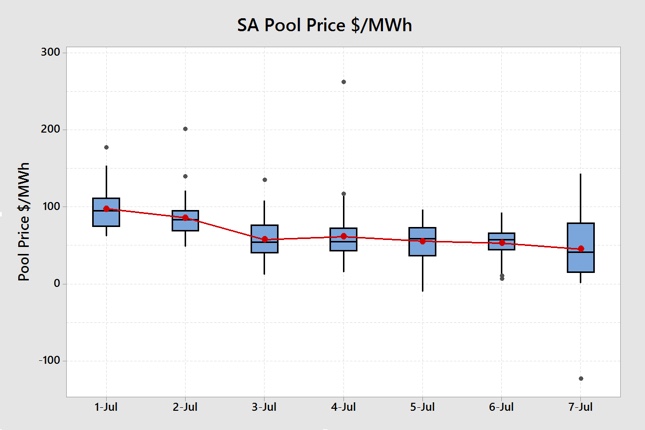

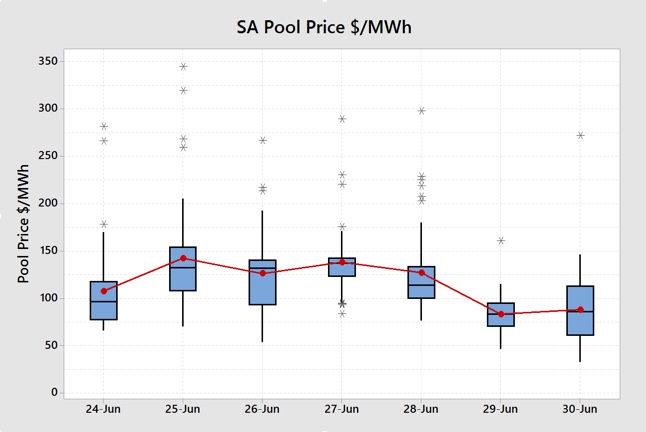

Figure 1. […]

Figure 1. […] Figure 1 Daily SA Electricity Price Box Plot (Data Source: NEMReview)

Figure 1 Daily SA Electricity Price Box Plot (Data Source: NEMReview)

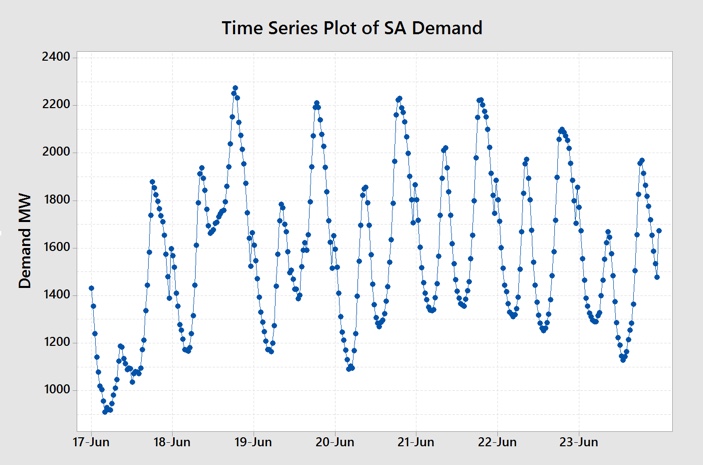

Figure 1 SA Electricity Demand Time Series (Data Source: NEMReview)

Figure 1 SA Electricity Demand Time Series (Data Source: NEMReview)